‘With the good projected rains this year, do you think I should grow maize?’ This is among questions a lot of farmers that have read both my book and my articles have been asking me. I understand their viewpoint that when the rain season is good, many farmers grow maize and soybeans so well and this leads to oversupplying of the commodities on the market. This was the case a few years ago when a lot of grain went to waste because FRA was compelled to buy more than they needed and yet they did not have adequate storage facility; this was all because it was an election year. I have a feeling that even with good rains, the commodity prices will still be good especially if the project to supply 600,000Mt of grain to Congo DR goes through. Here are some reasons that make me think that way.

The major markets for our agricultural commodities in the past five years have been the local market, Zimbabwe, Congo DR, Malawi and to a lesser extent Angola and Tanzania. A few times, we have endeavored to export to Kenya. These will still serve as key market opportunities for us next year. Firstly, East Africa has just completed its main production season and they did not receive good rains. They will likely be looking for maize and other grain foods next year. If we organize ourselves so well, we could just tap into that market opportunity. Zimbabwe, though they might have good rains may still need to import other grains especially soybeans. That country runs a government supported production program called Command Agriculture, which is more well organized than our FISP. They centrally procure seed, fertilizer, pesticides for the farmers; this makes the farmer attain higher yields. I have interacted with some smallholder farmers in that country at main functions and meetings who are getting as high as three tons in soybeans and five tons in maize. The biggest challenge that the country is facing now is not having forex to procure these inputs; this will make the country not to grow enough and that will compel them to look to other countries like Zambia to supplement their annual requirements. On the other hand, Congo DR is a market that needs no introduction. As that country’s mining industry keep recording higher production, with the opening of new mines, they will need more food and the beauty with the Congolese is that they have money and buy through cash transactions. They will need more than 600,000Mt of maize, cooking oil and a lot of vegetables. Malawi gets all their wheat requirements from South Africa and the continual disturbances of farmers from South Africa may lead to production to continue to slump as they try to relocate. This will lead Malawi to look elsewhere for supplies and Zambia can easily tap into that market. Additionally, the population of Malawi is about 18million people and the size of the entire country is about the size of northern province with the lake occupying a quarter of that land mass. The country has been depending on tobacco for forex as well as tea and macadamia. Many farmers are diversifying from maize and tobacco to macadamia; this may mean that they may just need a bit of some maize for their sima.

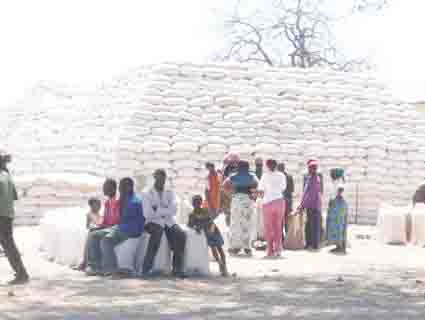

On the local front, one province which has been the second producer of maize in the country is disadvantaged. They are coming from a very bad season as they had a drought coupled with cattle diseases. The farmers of Southern province have been buying food since March this year and they might not just have enough money to buy adequate inputs for this coming season. This will imply that many of them will continue to buying maize next year. Additionally, the government may try to make the farmers happy next year by having a good price for commodities as they always do when they smell an election.

For the farmer, my advice is that let them use the best inputs in this year’s production effectively so that they can yield the best. Profitability in farming relies on nothing other than productivity; this is documented so well in my book which you can easily access by visiting www.amazon.com/Guide-Agribusiness-Zambia-Opportunities/dp/1796019127 alternatively you can order directly from the publisher at www.xlibris.com. Lastly, may I advise the government that with the newly discovered gold in Mwinilunga, they should not give away that resource to foreigners in the name of investors. Let us develop it ourselves or if anything, we should have at least 60% shareholding like our colleagues have done in Botswana; that will be better than trying to nationalize the copper mines. We discovered that resource ourselves and the mining explorers that they gave licenses have spent many years mining our resource without telling us that there is gold as has been the case in Eastern province. If we could have that mine and the yet to be discovered oil which we know we have, then the government can have an alternative source of revenue than taxing us to our graves; we are not investing as citizens because our disposable incomes have depleted so drastically. All the money goes to paying taxes including toll fees.