Qatar and Saudi Arabia square off in a major diplomatic feud. Suicide bombers strike at the heart of the Iranian capital. Kurdistan moves toward independence, and war rages on in Syria and Yemen.

And in the oil market? Prices just kept sliding.

Only a few years ago, bad news from the Middle East would have triggered a frenzy of speculative buying in the oil market, sending prices higher. So far this week, Brent crude, the global benchmark, is down more than 4 percent despite crisis after crisis hitting the region.

The muted reaction is a sign of how years of oversupply have created a cushion of large oil stocks that limits price spikes. By some measures, the world is sitting on top of about 600 million barrels of extra crude inventories, enough to offset the whole production of Libya for two years.

“In the current environment where stocks are still high, the market needs an actual — and large — disruption rather than the risk of one,” said Amrita Sen, chief oil analyst at consultant Energy Aspects Ltd. in London.

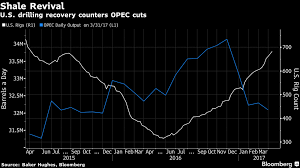

On top of the high stocks, OPEC now has 2.1 million barrels a day of spare production capacity, the most in four years, that it could use to offset any disruption, according to the U.S. Energy Information Administration. And non-OPEC countries such as Russia and Kazakhstan, which this year joined the producer group in cutting output to reduce the oil glut, could also reverse the curbs.

Finally, U.S. shale output could ramp up fairly quickly, too. In the past, the oil industry took years to react to any price rise, but now shale companies can bring wells into production in places such as Texas and Oklahoma in just a few weeks, acting as second line of defense against disruptions.

With plenty of cushioning available, oil investors are focusing on short-term production and demand, which continue to point to an oversupply. Official data shows that U.S. total petroleum inventories last week rose 15.5 million barrels, the biggest weekly increase in nine years. The stockpile jump, which caught the market largely by surprise Wednesday, was more than enough to offset rising tension in the Middle East and drive down Brent prices to their lowest since November.

Powder Keg

“You could be forgiven for wondering how on earth the oil market did not close higher yesterday,” said Tamas Varga, an analyst at brokerage PVM Oil Associates Ltd. in London. “The Middle East is starting to look like a barrel that is filled with, not oil, but gunpowder that only needs a spark to go up in flames.”

It won’t comfort bulls that today’s market has some parallels with that of summer 2014. Then as now, prices briefly rallied in response to a Middle East crisis when Islamic State captured the Iraqi city of Mosul in early June, only to begin sliding when it became clear exports were unaffected. That was the start of a deeper sell-off which eventually saw prices lose 60 percent by the following January.

The current crises appear unlikely to affect physical oil flows. The war-of-words between Saudi Arabia and Qatar has so far had no impact on crude and natural gas production, although it could complicate exports due to shipping restrictions. While Qatar is a large exporter of liquefied natural gas, it’s a small crude producer, pumping 620,000 barrels a day, less than what the Bakken shale basin of North Dakota.

While the dispute could strain the Organization of Petroleum Exporting Countries, of which both Saudi Arabia and Qatar are members, it’s unlikely to affect policy. OPEC is used to dealing with family squabbles.

Nor are Wednesday’s terrorist attacks in Tehran, hundreds of miles from the nation’s oil fields, likely to slow exports. So far Islamic State, which claimed the attack, hasn’t shown the capacity to target the Iranian oil industry, which is concentrated near the border with Iraq in the southwest of the country and on the Persian Gulf coast.

The independence referendum in the Kurdistan region of northern Iraq, scheduled for late September, is also unlikely to disrupt oil production. As the poll is non-binding, it probably won’t lead to conflict between Erbil, the Kurdish capital, and Baghdad.

In the past, incidents like these could have “sent oil prices through the roof,” said PVM’s Varga. “Not this time, which tells us that the oil market will only get support from bullish facts and not bullish expectations.”